Every quarter, Frédéric Lasnier, CEO of Pentalog, analyzes the eco-socio-geostrategic plate tectonics of modern business. As the head of an IT company in 16 countries with a headcount of 1,300, he shares his thoughts and advice on making the right decisions.

At this very eventful back-to-school period, new signs of crisis governance are making their appearance.

It is becoming clear that although we have made great strides in living with this crisis, it’s not over. To start making the right decisions, let’s get health issues out of the way at the start:

- Vaccination slows down the pandemic and reduces its effects.

- Economic conditions are closely linked to the effectiveness of vaccination campaigns.

- Economic recovery is significant in territories that have high vaccination rates.

- The effect of RNA vaccines appears to be shorter than expected, although they continue to reduce severity over a longer period.

- We will have to go through a third dose of mRNA, then a fourth, a fifth … unless more traditional vaccines take over.

- Unvaccinated populations accelerate the spread of the delta variant.

- Recombination of different strains of Covid-19 is greatly feared, even though RNA vaccines adapt quickly.

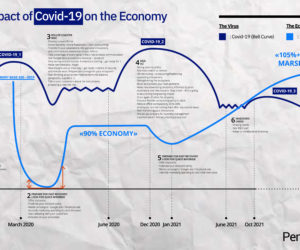

Another major fact has been established: we are now in a long epidemic pattern – 3 years? 4 years? 10 years? We can’t say, but that means that for exposed sectors, the crisis risks going into irreversible phases.

Off the top, tourism will never return to its original form, and bankruptcies are likely to multiply. Tourism will be globally disrupted, emptied of interest for investors and savers. Logically therefore, commercial aviation, as well as physical retail, will be impacted. We have written here before about the effects of a long crisis, although I confess, I thought we would avoid it; I was wrong. At the very least, thanks to advances in vaccines, we can assume that it will be less nasty than in its early phases.

Winners and losers

With this as background, political governance can hardly change its objectives. The practice in the most advanced states continues to hinge primarily on health objectives. So there are no big changes to look forward to. It is clear that the strongest growth rates can be credited to the most vaccinated countries: France, Israel, the UK. Other highly vaccinated countries have already reached the economic levels of 2019; this is the case for the US and Germany (very soon), for example. There is no reason for this pattern to change for a long time. The most advanced countries are the winners of the Covid crisis, led by the US and followed by a number of countries in Europe, along with Japan and Korea. Emerging countries are groggy; their level of infrastructure, monetary security, and corporate productivity have not always held up. So this pattern will continue into 2021, and probably a good part of 2022. From a cost point of view, going into emerging regions in 2022 could therefore constitute an interesting bet.

As for China, heralded as the future big winner in the economy of masks and paracetamol – it won’t come out of 2021 as well as all that. Something is not working between Xi’s power and tech companies. Xi does not tolerate the fact that these companies can take advantage of more information than the Chinese state: and he does not yet have the credibility of the American state to impose a Chinese “cloud act” on the companies of the Middle Kingdom. The result is growing mutual mistrust and a genuine risk that the country will slow down around what seemed to be its principal strength. It just goes to show that communism is not dead and can still shove its nose into digital capitalism.

Overall, the Chinese position has not been strengthened, and its attempt to set up a new soft power will fizzle out in a damp squib:

- The Hong Kong crisis has left its mark.

- The pangolin, an almost ideal culprit, seems in practice to be less and less guilty, and Beijing’s management of the crisis is increasingly inadequate. The origin of all this is no longer open to doubt.

- China has not only failed to produce a good vaccine candidate – it is also not vaccinated.

- Western countries have taken notice of the gaping holes in their supply chains, and started to react.

Certainly, China is no longer in a winning position, and Xi Jinping has lost a good deal of credibility. The Americans have seen all these signals and are determined to push their pawns and challenge Beijing on issues of maritime sovereignty in general, in the China Sea in particular.

What’s in store for decision-makers in the next 6 months?

There has been a lot of talk lately about inflation. It is true that it reached notable peaks in the US, for example, where the 5% threshold was largely exceeded in July. But the rest of the world is reassuring in this area. Both inflation and shortages of goods seem to be due to the palliative treatment of the crisis. The Trump administration’s checks have been spent and there won’t be any more of them. Everyone has understood this.

So even if prices have in fact gone up, European inflation (including the UK), is not very alarming once all other parameters are taken into account. The expected interest rate adjustments are likely to be weaker than the US political and monetary authorities dreamed. Allowing for inflation, real rates should remain negative in most developed economies, certainly favoring more aggressive investments.

What’s the story with bitcoin, stocks, real estate, gold, and reserve currencies?

What is the significance of bitcoin’s irresistible rise and return to $50,000? To understand this, you need to mix into the analysis the strongest asset classes at this time: gold, equities, real estate (which is experiencing very diverse fortunes but which only rarely goes up), and the two major currencies.

Given the crisis we are going through, the dollar and the euro have remained incredibly tied to each other. In the space of a year, virtually nothing has happened. One (USD), driven by growth and slightly higher rates – the other (EUR), by the incredible commercial solidity that the Eurozone continues to demonstrate. Is that clear? Note that the Euro Zone can indeed afford to post lower rates than the rest of the world. It is politically stable and its current account balance is structurally in surplus – which is not the case for the US. As for the cumulative budget deficit of its members, it is much lower than that of the US or Japan.

So if inflation isn’t all that scary at the end of the day, and reserve currencies have leveled the playing field, then what happened to gold, bitcoin, stocks, and real estate? Well, the world no longer protects itself by buying reserve currencies, or even (highly inaccessible) gold; instead, the world has discovered – and places incredible confidence in – bitcoin.

Should bitcoin go green, and democratize as a payment instrument, it will be universally adopted as a replacement for current accounts in local currencies. Depoliticized and limited in issue, bitcoin can only outperform the Euro and the Dollar. Since nation states can’t do much anymore, they need to hurry up. Later, it will be too late and they will only have the option of taxing it… something that is hard to apply to this asset class.

The number of users has therefore increased during the crisis, taking a bite out of gold. Bitcoin’s market dollar value has roughly matched that of gold. But while one (bitcoin) was up strongly over 12 months, the other (gold) fell.

Be careful however of backlash! Bitcoin and cryptocurrencies are not evenly distributed around the world. Extremely popular in emerging economies, bitcoin is little more than an annoyance everywhere else where markets and power are spread out.

Covid-19 means digital productivity!

Just as the crisis has established bitcoin as the Number One asset, it also highlights the explosion in digital productivity. If, only yesterday, centers of economic activity were still not very concerned by digital, that period is over.

Companies like Pentalog, digital freelancer marketplaces, and recruiters are all hassled by the needs of businesses. Those who had invested heavily before the crisis are the clear winners, producing catch-up hysteria in the rest. For many of us, even if 2020 results were fairly good, we will post organic growth of 15 to 25% in 2021. It’s quite simple: Gartner estimates that global IT spending will increase by a historic 8.6% this year. It had already increased by 3.7% in 2019 and 0.9% in 2020. In other words, and in simple terms, the pace of growth has more than doubled compared to 2019, and we do not see any decline looming in 2022. Covid is clearly an accelerator. Teleworking is becoming the norm in the tertiary sector, and that fact is simply irreversible. The resulting lessons are clear:

- If your company consumes a majority of digital, human, and technical power, and your expenses have increased by less than 8.6% in 2021 … then you are increasing your digital debt.

- If your company is in technology or consulting and you are making less than 8.6% growth, you are losing global market share.

This materialization of digital efficiency under the eyes of everyone is igniting the shares of digital companies in the stock markets, much more than bitcoin or pharmaceuticals. In the 2020s, these are the ultimate assets to own: digital tech, Moderna and Pfizer… What else is there…?

In conclusion, what to do between fall 2021 and spring 2022?

- Consolidate all the gains in teleworking. Reduce the areas allocated to tertiary work even more. The ‘return to the office’ is an illusion, and in a growth market, a turn-off for hiring.

- Carry out a 360° audit. Has your business mission changed? Have your market opportunities changed? Have new barriers emerged? Is your pre-Covid team ready for post-Covid?

- Increase channels for digital training in the company, increasing productivity in a context that is strongly oriented towards teleworking.

- Seek out customers and investments who are, given this new context, in the sectors of the future: digital leisure, EdTech and personal development (education technologies), biotechnology (RNA in particular), retail e-commerce, tourism and aviation disruption (outdoor sports, camping), SaaS, IOT, FinTech and cryptocurrencies, furnishings, private real estate, real estate disruption, Tech Services, HR disruption, Green Tech …

- Enhance your company’s digital teams in emerging countries. Competition is becoming unsustainable – it’s no longer a question of costs, but of availability!

- Start marketing into expanding and most profitable geographic sectors: UK, US, Canada, Germany, Austria, the Netherlands, Switzerland… The Anglo-Saxons are outperforming everybody else – and everybody else needs to address them.

- Open the corporate door (at least partly) to bitcoin payments, if some of your product-service / customer pairs permit it.

- Train your teams in new lightweight application design and deployment: “low-code” and “no-code” are perfect instruments of digital guerrilla warfare.

- Market your new differences intensively.

Let’s meet up again at the end of December, with the report on 2021 and the challenges in 2022.

Until then, take care of yourself and your teams.

Further reading:

Coronavirus: What if the pandemic lasts 5 years? How about 10?

Are You Prepared for Post-COVID-19 Economic Hypergrowth?

Organic growth of 25% in Q3, and soon more than 100 recruitments per month!

(5 votes, average: 4.20 out of 5)

(5 votes, average: 4.20 out of 5)