Not quite two months ago, I published an article on the (then) risks to the global digital economy. Even though I unfortunately underestimated the real impacts, I was basically right.

Now, two months later, many people have died. A friend of mine went through a period of great suffering. And it will continue. Everything that follows may seem preposterous.

However, we’re now feeling that economic pain will be added to our physical suffering, and will multiply in our souls.

These are very hard moments. The most difficult economic crisis that could have been given to me would have been to live out as an entrepreneur. And at the age of exactly 50, I’m on my fifth.

So I embarked on a series of initiatives, to help with the thin means at my disposal. But I’m nothing more than an entrepreneur, a creator and a bit of an economist.

One of those initiatives has been our PentaLive web broadcasts, initially in French, and starting last week, in English. We have decided to open the PentaLive program to free access, providing an up-to-date and timely mix of information, with the initial goal of collectively getting us out of chaos, and the follow-up goal of providing free access to our tools of conquest.

PentaLive provides decisive advice, all under the conviction that together, we’re better, using the same actions and taking inspiration from the same timeline.

Everything started at that time from the idea of forecasting the risks that we considered, and it’s clear that we almost hit the bulls-eye. In fact, it helped some people, including ourselves, to anticipate some very big decisions. But not enough of them.

Today, I have two goals:

- Update the list of sectors at risk. There are some surprising oversights in this crisis.

- Share our new vision of the beginning of the economic cycle that has opened up. First, because our initial economic hypotheses have been tested and proven at this time. There is certainly an interest in acting together and listening to each other between companies, to get out of the chaos. But we need your comments and advice to be successful.

Heavily affected sectors, easily identified from the start, those that appeared and those that are still to come

Let’s start with the easiest, already mentioned two months ago:

- Travel. This sector is totally confirmed. By our estimates and those of our customers, spending (tech and marketing) in the ‘digital’ travel sector is about one-third of what it was before. Quite simply. Technical unemployment, broken digital agencies. Everything goes there. No restart before end July – beginning August. Very feeble. Probable relapse between October 2020 and April 2021. Full recovery between July and December 2021.

- Cosmetics and luxury goods. Total collapse of store sales. Less need during lockdown. Online selling compensates slightly. Totally dependent on reopening retail and on external web platforms. Timid recovery expected in May, getting stronger during the summer. Risk of new lockdowns everywhere between November and March. They will probably still not be ready from an eCommerce perspective. Their structural digital spending will explode in order to cut out the ‘middle-man’. Manufacturers in this sector are under-digitalized while their financial margins are enormous.

- Clothing … Same fight. But recovery probably a little faster. Wardrobe delays to be expected. Our clients give various strategic signals.

- E-commerce – at least, non-food, non-tourism, non-clothing … Will hold up. It will take a lot of market share from non-digital, who will obviously be the huge losers. A lot of breakage to be expected for these sectors later in the cycle. I have great confidence in companies like made.com, for example, in its competition with classic furniture retailers. They will soon be the only ones able to deliver. Much more agile from start to finish. Including in the supply chain department. This kind of company will accelerate like never before.

- Automotive. Yes, the car and personal travel was becoming one of the biggest digital spending sectors in the world. At the frontiers of IOT, cloud, GPS, electrification. This sector will be crucified. No one changes cars at times like this. Margins are not wide enough to withstand the shock. The damage will be much deeper than in 2008. Most manufacturers are not yet ready for electric. Between those who are waiting and those who can no longer afford it, this sector has started to lay off and cancel its engineering orders en masse. (Phew … we don’t have one at Pentalog. It would be great to have one, but maybe now is not the time.)

- Aircraft manufacturers. Large consumers of on-boarded technologies, have also significantly reduced capacity. Paradoxically, this downtime is likely to allow Boeing to gain time in its competition around the 737 product range. Seeing aircraft construction expectations collapse also says a lot about projections in tourism.

Then there are the sectors that nobody would have thought of, but none of them are purely digital …

- Real estate and real estate management. Imagine how good it’s going to be to collect rents on empty offices and closed stores. Not. With what we are learning from tele-work, can you imagine how many years it will take for this sector to – maybe -restart? I’m betting a drop of 20%. Maybe 30%. In any case, as an entrepreneur I will never take on as many square feet again. I already have my ideas on the percentage of the reduction.

- Private real estate is also in disorder. Impossible even to visit prospective purchases. The percentage of rejected credits must have exploded. And who wants to go into debt now based on values posted yesterday? Maybe it will start again in a few months. But this will not be a year of corporate transfers, or household moves… No, the year will be black at first, then dark gray – and it will last like that for a while. The market will land and resume. In a long time, and it will have to absorb the propensity for reducing professional space occupation.

- Private construction. For reasons already described.

- Show biz and the movies. I would not like to own a theater or a cinema chain these days…

Unfortunately, we could extend this list endlessly.

Many other sectors will obviously be affected by this via later ricochets, mainly due to a progressive decline in consumption and investment.

And the winners – are there any…? Loads!

- The whole “remote” sector. Remote – whatever. Food retail, as long as it has end-to-end control over its chain, dating, sex, social platforms, teleconferencing, logistics that will move towards “tailor-made”, the Last Mile, your door.

- The “temp” market – temporary workers, couriers, delivery people, the uberization of logistical work.

- Remote education. Lots of time, lots of unemployment, lots of internet. Edtechs are in high demand – we have a number of them at Pentalog. The demand is almost literally exploding.

- Online leisure. Games, VOD. (I’m not even sure that you’re reading me!)

- SAAS / PAAS tools. Thanks to COVID-19, the good old cloud will double its turnover in 2-3 years. These tools represent 40% of our customers.

- IOT … does the job for humans without getting sick, it controls vital parameters, it simplifies logistics, it’s not contagious. IOT will become to the modern world what salt was to the Middle Ages.

- GAFAM (Google, Apple, Facebook, Amazon and Microsoft) – well of course!!!

- China. Or rather: CHINA! Strengthening its soft power through its status as mask factory to the world. It will burst almost literally into the governance of certain European states (Greece, Italy, Spain?). And I think that its production capacities, both native-internal and abroad, will make it the new backbone of global interdependencies. Its exit from the crisis (slightly jumping the gun…) and its ability to operate inside a closed circuit makes China, de facto and for very many months, the only power capable of producing, including in its home market.

If I wanted to summarize, I would say that the world of COVID is a world where three things really count: caregivers, the Cloud… and low wage earners. COVID disintermediates the world like nothing ever has. A central nervous system and our little hands – that’s all we have. The rest is no longer of much use. This will of course be of great importance for the future.

What could the coming months look like and how to anticipate and act at the right time?

As in 1991 or 2001, this economic crisis was triggered by relatively visible events coming in from outside the economic world, resulting in brutal and in the final analysis almost immediate effects.

As an entrepreneur, the first thing we need to do, after measures taken following the effect of amazement (end the trial periods, give up major purchases, interrupt important financial decision-making, stop debt… ) is to wonder what other players will do – and when?

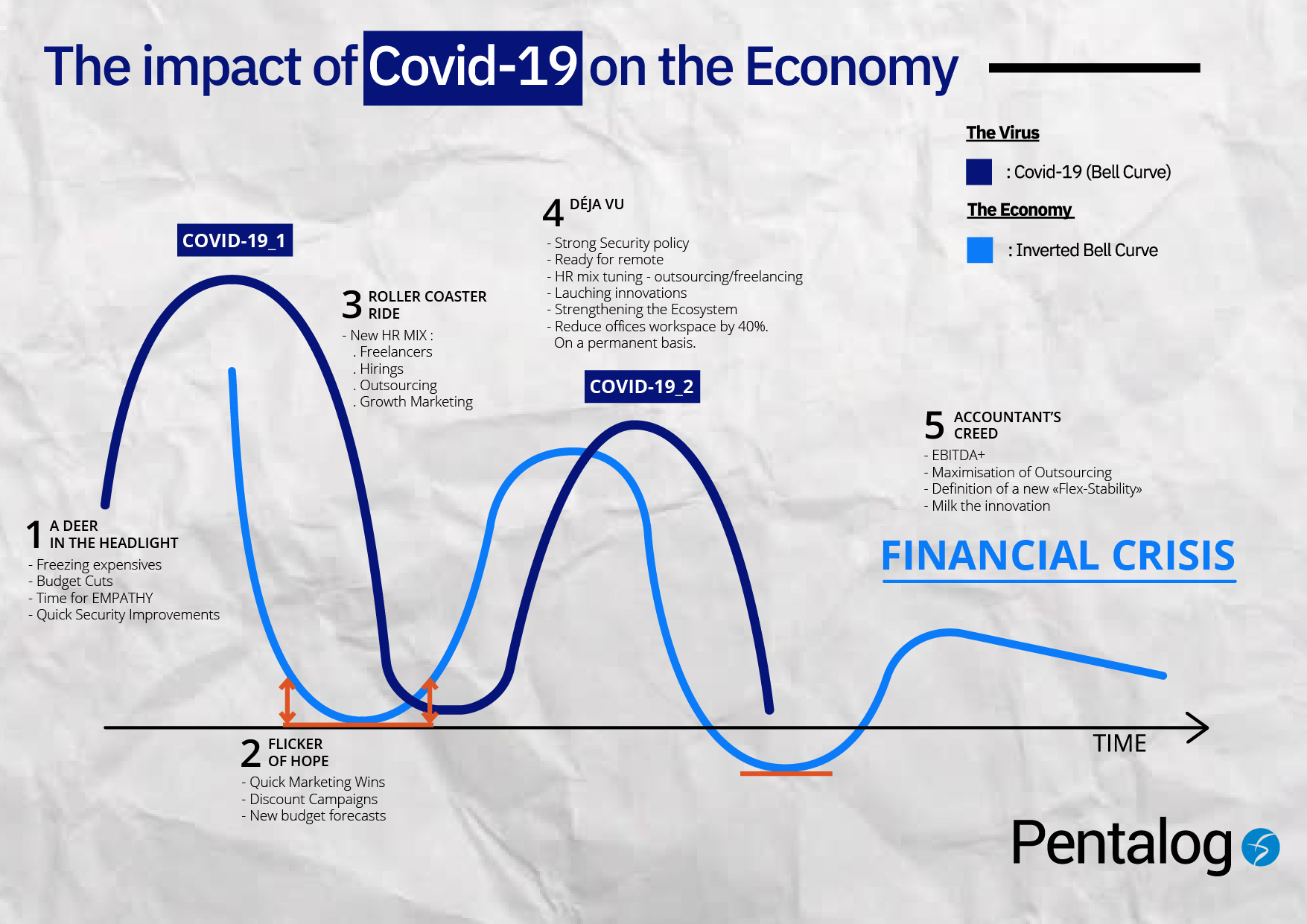

WHEN… the key question. It will not arise only once, in our opinion, since we are now planning five major stages over the next 12 to 15 months, undoubtedly with specific actions for each.

The diagram that I want to share with you is a key element of my management as CEO. At Pentalog, we are already entering the illustrated Second Phase (2. Flicker of hope). Amazing after-effect, the most daring, the luckiest, the most protected, the most gifted … are already replacing elements of growth policy. Do not miss the first rebound wave because otherwise you won’t survive the second fall-off!

This is what I decided to do for Pentalog. Our marketing campaigns resume this week. You will see them, here and there, on your networks. And that’s not by chance.

Milk the innovations

Detect your weak signals and observe the environment

Since March 30, we have seen our signals multiply. Leads are coming to us. Big ones, even. So you have to start knocking on the door again, focusing on the value of your service, minimizing the risk and the price.

What about the economic environment? Well, that was what gave the signal for this first phase and the smart ones who read the science journals have known about it for a very long time. A coronavirus operates on a bell curve and it will weaken slightly in the springtime. And watch, listen … what are we saying? Light at the end of the tunnel. Even if it’s only a little light at the end of the first tunnel …

I therefore encourage you to stay tuned for some “Growth” lessons from Pentalog’s own Jeff Mignon, one of our digital thought leaders, on PentaLive. And while you’re waiting for the upcoming PentaLive sessions, you can get some idea of Growth Sprints on our blog.

Why is this Phase 2, shown on the diagram above, so crucial? Well, because it will be the strongest rebound phase in a cycle of successive depressions. It is imperative to take advantage of this, to climb as high as possible before the next risk of lockdown. If you don’t bounce back by then, you will have no chance of getting through the next period. So you must sell – you must dare to sell – to discounts. Isn’t that what all traders do when a situation suddenly deteriorates? You need to publicize your promotions, your specific offering for this period … At Pentalog, we have already determined our specifics: to de-risk start-up outsourcing contracts by offering the first month free. Now, your turn -find your offering!

The 3rd Phase (Roller Coaster Ride) will come very quickly and it will be critical. Fairly strong recovery. But be careful not to be fooled, because we will very quickly fall back. COVID isn’t going to let go of us anytime soon. You will therefore have to re-adapt very quickly. If you have kept your customers and your teams in the same quest for solidarity, you have played well.

But beware: this is the last ascent before the descent into hell. So no overstaffing. It is probably time to adopt a new staffing strategy for your teams, and for several reasons. You need to review your HR mix, that is, the distribution between your internal staff, outsourcing, and freelancers. On the one hand, effectively because you may have to respond to a cramdown in the end, but also because you will have to innovate. A long and lasting crisis is looming and you need to adapt in depth. Innovate. As I note above, COVID will disrupt the organization of work and society as a whole. Maybe even politically. We’ll talk about it again in a few months.

You need to improve your existing teams with fresh and flexible resources. You have to learn to sell differently, maybe something else, innovate differently, in a decentralized way, run the business differently. You need to deploy agile on every floor of the company, starting with product and service innovation. Until the PentaLive sessions start, Pentalog’s Jeff Mignon (whom we met earlier) can start providing you with a master class in design sprints.

Then comes the Deja Vu phase, a watered-down, copy-paste of COVID19_1, in early 2021. Here, you just have to be ready. If necessary, reduce your flexible positions since, if you’re following our lead, you will have started to adapt your company. Companies that have deployed qualitative outsourcing will be way ahead in implementing innovations from the period. And this phase will directly link to a classic economic crisis: either washed away by waves of inflation, or blanked by 20 years of recession, stagflation.

Finally we reach our destination: a real, full-blown, old-fashioned, financial crisis, against a backdrop of government debt, inflation or fiscal hyper-pressure. The middle class will be washed up and washed out for the next four to seven years. The longest cycle of expansion in modern economic history could well be followed by what may prove to be a very long cycle of depression. Your business will have to be super agile, digital, decentralized. Quietly, capital will return to companies from the start of this phase around September 2021 to early 2022.

Companies with positive EBITDA (Earnings before interest, taxes, depreciation, and amortization) or even positive EBIT – will be the winners, and ultimately almost the only ones who will be able to make it through hell before entering the long but more reassuring recession. For a time, the accountants will take over.

Helping you to read these phases – sharing our information – understanding agile tools and frameworks for getting through chaos – all this is what I mean by my commitment to my entrepreneurial community.

I will regularly update the entire process to improve the accuracy of forecasts. But remember that the key to these rollercoasters is the ability to accelerate, then decelerate. No one really has any experience with this, and only the most agile and flexible management concepts can achieve it.

If I seem too sure of myself – I’m not! I know that these forecasts will have to be revised continuously, since they are the first steps towards an end to a crisis of agility.

Lexicon:

* You should take note of the fact that the five ‘phases’ could be slightly shifted in time, depending on the geography of your company. Purely national firms could find themselves operating under different timing from transnational European or American firms.