The new fall-winter variant has arrived – Omicron – and you can’t say it’s been quiet. What little we know about Omicron suggests we’re in for another long winter. Even if the vaccine booster shot seems protective, we’re a long way from out of the woods.

Omicron incorporates multiple mutations to the spike protein. This is its essential characteristic, so it will mutate from that starting point. The variant’s contagiousness seems to take precedence over Delta with the expectation that Omicron will take the first position.

The good news? Several early studies are showing that a third shot, the vaccine booster, has a protective effect. So far, it’s looking like the Pfizer jab performs best, but the data are early. And Pfizer’s CEO is already promising a booster update by March 2022.

But below this glimmer of scientific progress, the reality is that the world is already behind the curve administering first doses, never mind the booster! So, these measures will save only a little time. We need to act.

Is it already too late to avoid damage?

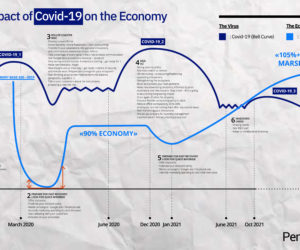

In economic terms, yes, it’s too late to avoid economic fallout from Omicron.

Some sectors are already beaten. Tourism and air transport projections are collapsing, since we know that it will take several months to widely deploy boosters and vaccine updates. Oil prices, now closely linked to state health announcements, are also falling. The reactions in these sectors are now instantaneous.

On the other hand, tech will once again resist the downward pressure, and will perform much better, even achieving unprecedented growth rates. Despite considerable acceleration in the speed of our recruitment, our pipeline remains full. At Pentalog, we’ve gone from an average of 3 months between the start of a deal and signature, to 6 weeks.

Delays and disruptions are also to be expected in the vaccine policies of various countries. People will not fail to ask questions about the rationale for a third dose and will need reassurance very quickly. One consequence may be to cause the Delta variant to flare up. There could be unforeseen delays in validating new versions of the vaccine.

As a result, the winter will be difficult, and reconfigurations will probably be implemented around the world, with a possible depressive effect on consumption and the economy, and probably without a moderating effect on industrial inflation. We might see a weak drop in fuel costs at the pump, if restrictions and confinements return.

Taking mutations into account, according to Moderna, it could take 12 months to develop a vaccine refresh accessible to everyone. As noted above, Pfizer seems a little more optimistic. Let’s not forget we are living in a moment of pharmaceutical revolution, with a speed of vaccine production that could have hardly been imagined a few years ago.

What to do in the very short term?

The 2020 crisis taught us a lot: we cannot fail to act, but neither can we overreact. (I am of course speaking of companies, not putting myself in the shoes of countries.) For my part, I have just made the following decisions for Pentalog:

- Cancellation of trips and scheduled physical events. In particular, I refer to a global commercial seminar which we are going to move online. There is no way the company can take this kind of risk.

- Reinforcement of the requirement to wear masks in the workplace for those who must go there. Let’s remember the common sense of the pandemic!

- Telework as the standard for all. Only those with poor connections or very bad working conditions can be the subject of exceptions. As well, despite historic growth in our workforce, we are closing many square meters of office space. Tech workers have been clear: they don’t want to go back to the office. This is a global trend. From an environmental point of view, this is a blessing.

- Offshore/Nearshore/Outsourcing: Demand for these services will continue to accelerate as companies look to counter the price inflation of IT talent.

- Continued investment in digitalization projects that target improved supply chains and online marketing.

- Continued investment in digitalization projects for training, coaching, and remote operations management (Ops).

In any case, we’re in a different place and budgets for digitization should not be suspended, a decision many companies regreted making in 2020. The recovery remains strong, even as inflation is raging in tech, and stop-and-go economic techniques become too expensive. The same goes for marketing and sales. In the Northern Hemisphere, you need to prepare your organization for 3-6% growth above 2019 levels.

What steps do we take in a bull market?

In a bullish environment, companies need to be ready to avoid losing market share!

On the communication front, empathy once again becomes a key formula, even as you present anti-inflation measures that you can offer to your customers. You will need to check with your customers that everything is going well with them.

And finally, customers need to see the steps you are taking to counter the global scourge of inflation. This means controlling the supply chain and maximizing productivity and quality. Companies will explore new sourcing opportunities to hedge against inflation even as they propose new products and services to justify price increases.

Further reading:

Our Approach: Hiring Smarter to Win the War for IT Talent

6 Lessons from Agile Leadership to Win the War for IT Talent

Ever the Weak Link: A Human Focus on Digital Security